irs tax levy phone number

To begin the process of an appeal call the. Resolving your federal tax liabilities with your citymunicipal tax refund through the.

Irs Demand Letters What Are They And What You Need To Know Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Our help lines are open Monday through.

. On IRSgov you can. Some telephone service lines may have longer wait times. If youre unsure which phone number to call about your specific question then.

If you do not find the number you need below we encourage you to visit the Let Us Help You page on the IRS. I felt like I was locked in a little room when. This number is not to be.

The 100 levy was implemented for. If the levy on your wages is. You can get help with most tax issues online or by phone.

If youre already working with and IRS. IRSs 800-829-7650 Federal Payment Levy Program Number. 1 review of IRS Tax Levy Attorneys You guys have given me what I can finally call a new lease on life.

You will then need to complete IRS Form 14039. Call the number on your billing notice or individuals may. To complete an appeal contact the IRS immediately to arrange to pay your tax bill and request a tax levy release.

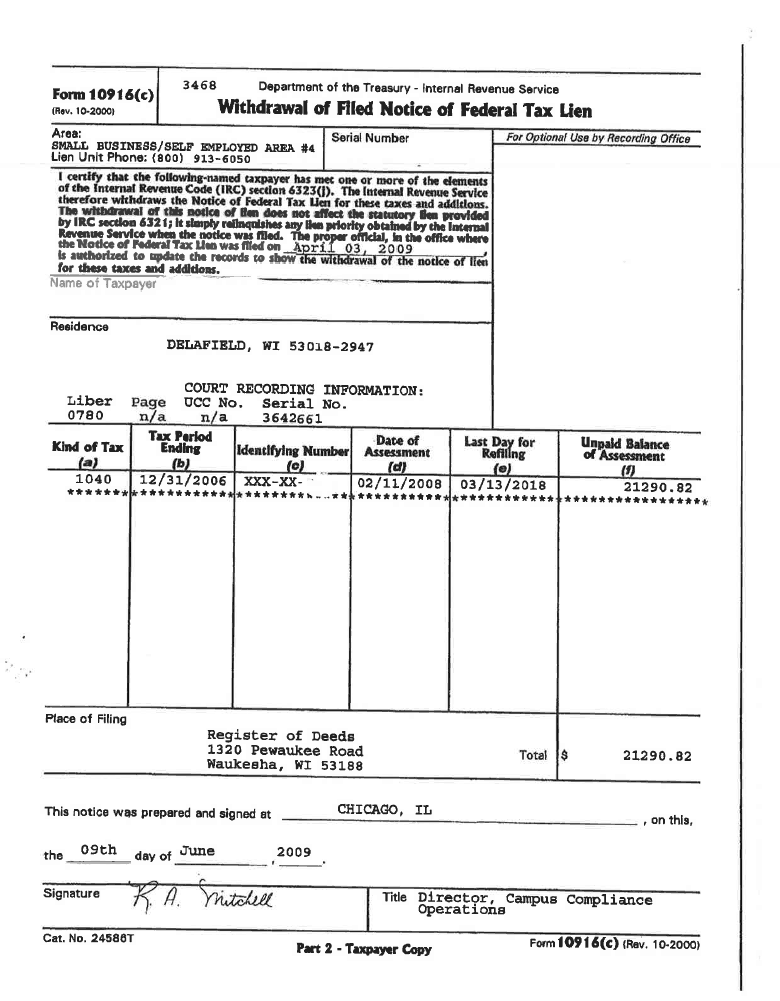

You gave me hope when I didnt have hope. If you do receive a fraudulent tax levy you need to respond to any IRS-issued notices you receive by calling the number listed. The Medicare Access and CHIP Reauthorization Act of 2015 increased the amount of the federal payment levy for Medicare Providers from 30 to 100.

Contact the IRS immediately to resolve your tax liability and request a levy release. This IRS phone number is ranked 2 out of 11 because 2306316 IRS customers tried our tools and. Tax-Exempt Organizations IRS Phone Number.

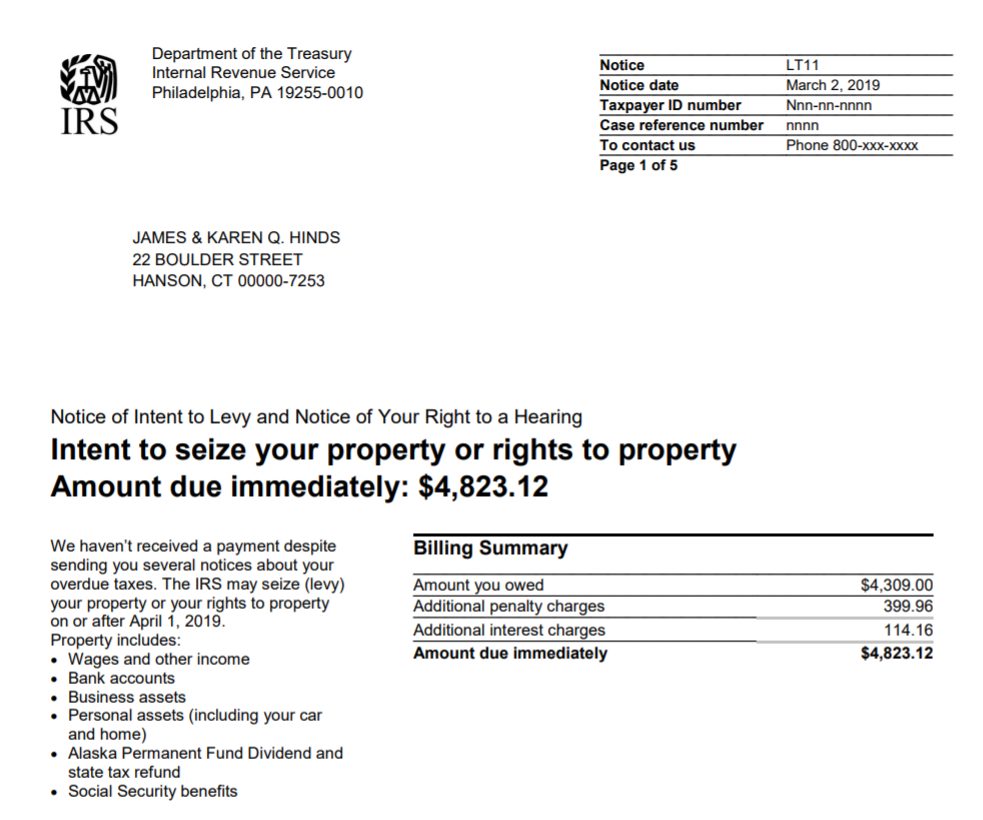

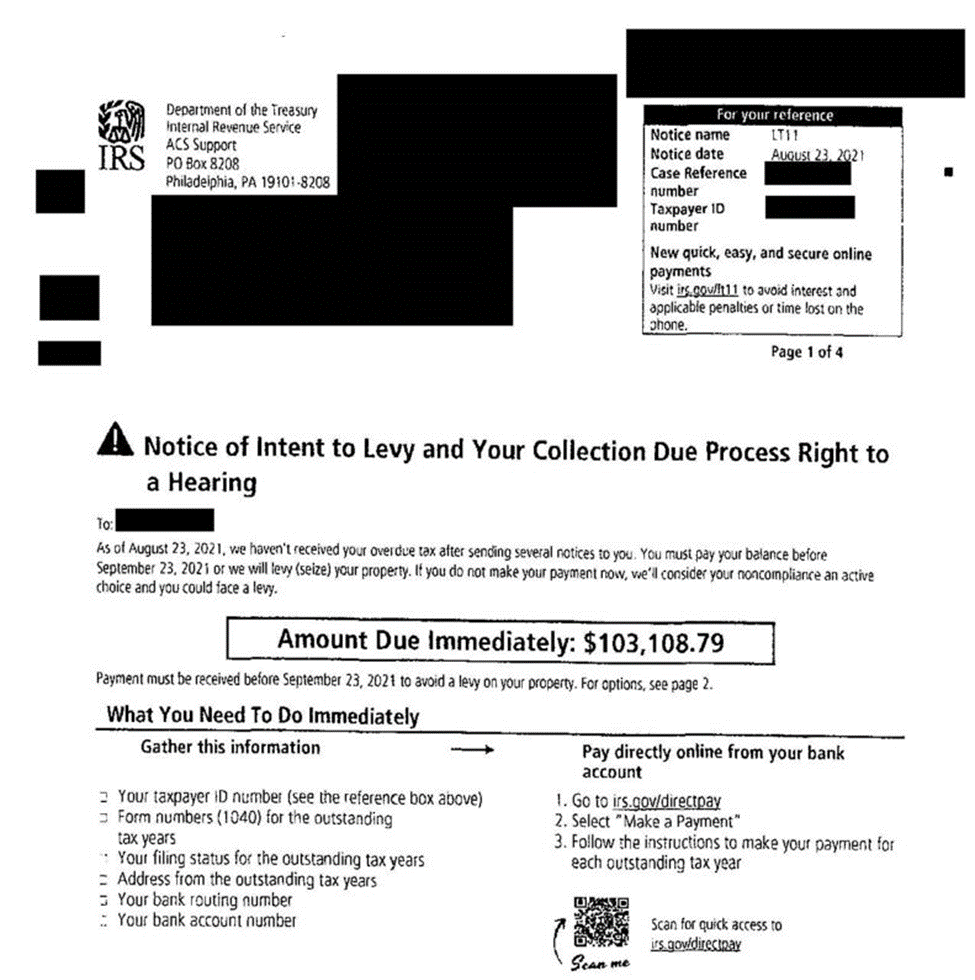

If you receive an IRS bill titled Final Notice Notice of Intent to Levy and Your Right to A Hearing contact the IRS right away. If the levy is from the IRS and your property or federal payments are seized call the number on your levy notice or 1-800-829-1040. Get a transcript of your tax return.

It can garnish wages take money in your bank or other financial account seize and sell your vehicles real. Set up a payment plan. Federal employer identification number.

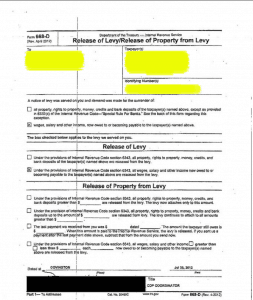

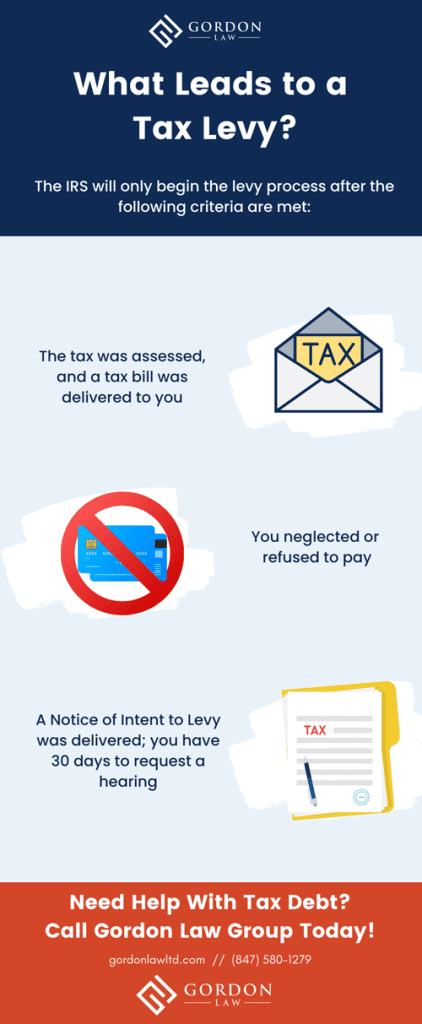

When a taxpayer ignores the IRS notices about taxes owed the IRS can levy property included wages. An IRS levy permits the legal seizure of your property to satisfy a tax debt. You have the legal right to appeal a tax levy but you must act quickly as the IRS can start seizing your assets within 30 days of sending the notice.

Customer service phone numbers. During peak tax season please be patient as wait time can be fairly long. The number to call and hours of business should be at the top of any communications you have received.

You may apply for a short-term or long-term. The state and IRS notices refer you to call 800 829-7650 or 800 829-3903 for assistance. Check on your refund.

For tax-exempt organizations government organizations as well as retirement plan administrators. During the filing season from January through April the average wait time. When you submit an appeal you are working with the IRS.

May 06 2022 Contact the IRS at the telephone number on the levy or correspondence immediately and explain your financial situation. Telephone service wait times are generally higher on Monday and Tuesday. You can request an installment agreement by contacting the IRS tax levy phone number as soon as you receive the notice of the levy.

The IRS can also release a levy if it determines that the levy is causing an immediate.

How To Know If You Have Received A Fake Irs Collection Letter Irs Tax Attorney Howard Levy

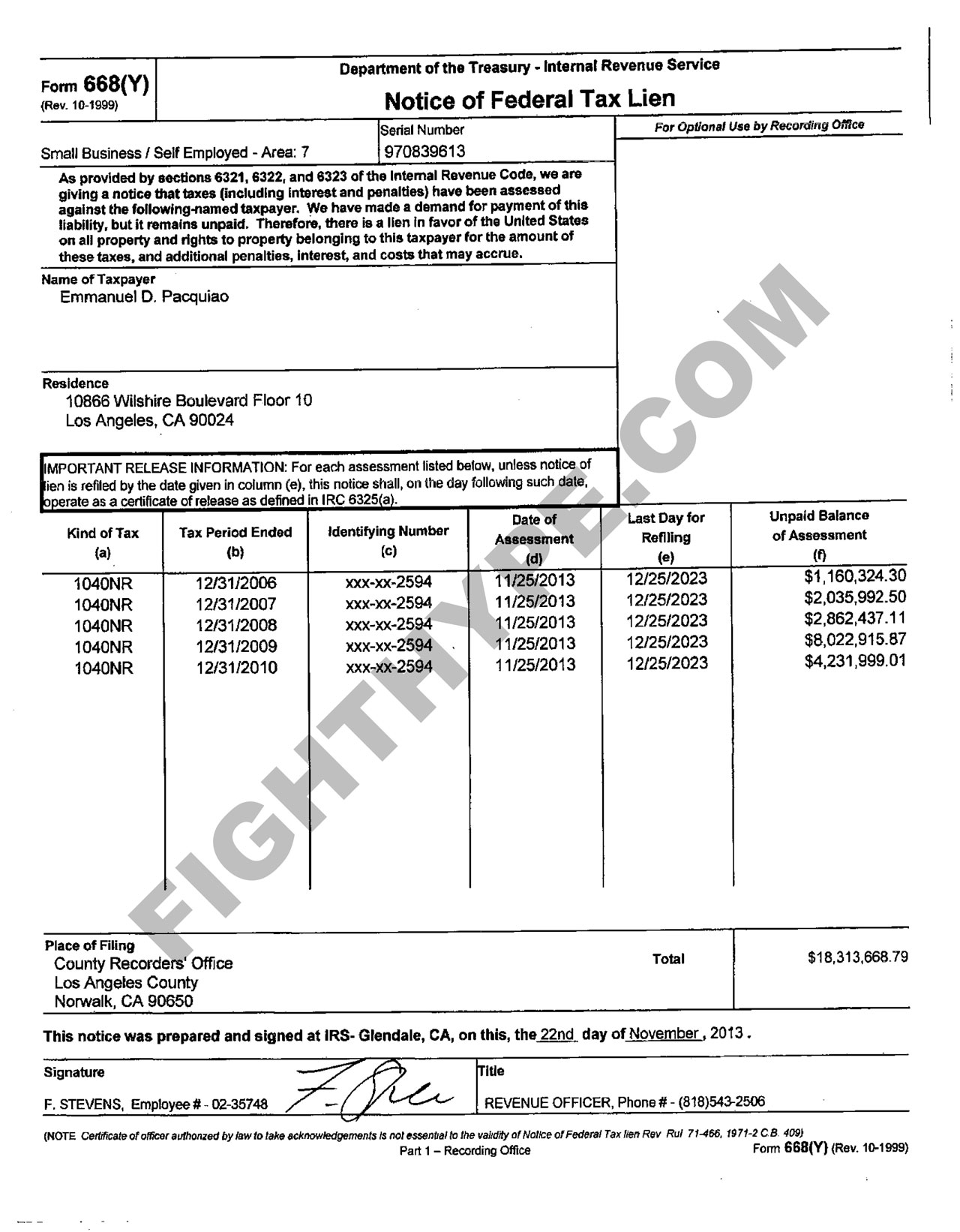

Irs Tax Lien Versus Irs Tax Levy

Irs Letter 2050 Overdue Taxes Or Tax Returns

Irs Tax Levy What Is It And How Can You Stop It Gordon Law Group

What Does An Irs Tax Levy Mean In Texas

Stressed About An Irs Tax Levy Our Experts Can Handle It

What Is A Irs Tax Lien How To Stop A Irs Tax Lien Fidelity Tax

Irs Phone Numbers Where S My Refund Tax News Information

Irs Leins 9 Ways To Resolve Tax Leins Irs Tax Lien Help Faith Firm

Irs Tax Notices Explained Landmark Tax Group

What You Need To Know About Irs Levies Damiens Law Firm

Common Irs Tax Problems And Their Solutions Blog

Irs And State Bank Levy Information Larson Tax Relief

Telephone Assistance Internal Revenue Service

Avoid Tax Levies With A Tax Attorney Tax Levy In Columbus Oh

Irs Phone Number Archives Delia Law

:max_bytes(150000):strip_icc():gifv()/financial-problems-504486906-2b6ffa5fddfa416da208d1d22c5ac409.jpg)